Colin Grimm

import random

from tqdm import tqdm

import pandas as pd

from bs4 import BeautifulSoup

import re

from near_regex import NEAR_regex

import requests

import os

import glob

from io import BytesIO

from zipfile import ZipFile

from urllib.request import urlopen

import seaborn as sns

import matplotlib.pyplot as plt

sample2_csv = 'outputs/sp500_accting_plus_textrisks.csv'

sample2 = pd.read_csv(sample2_csv)

SP_Mr9_Rtn_csv = 'outputs/sp500_plus_risks_and_ret.csv'

SP_Mr9 = pd.read_csv(SP_Mr9_Rtn_csv)

Risk Measurements

The three risk measurements I decided to use to test the sample of S&P 500 companies was: Increased Competition, Regulatory Pressure, and Supply Chain Disruptions. Increased Competition was the first measurement I decided to use, so I came up with three different variations on how it could be measured. The first variation is parsing the 10ks searching for any instances where “increased”, “increase” or “potential” was seen within 4 words of the words “competition” or ‘competitor”, my reasoning behind this is that usually increases in competition will negatively affect your business, so I wanted to see if there was any evidence to support this. The second variation was to search for any instances of the words “new”, “entering”, or “potential” within 3 words of “entrants”, “firms” or “company”, my reasoning for this is that sometimes firms may not want to mention increased competition directly, so they may use different words like these. The final variation of this measurement searched for “market share” within 7 words of “threaten”, “decrease”, or “threat” the goal of this variation was to search for any time where competition may be talked about in relation to negative effects for the company, such as a decrease in market share. The second risk measurement I decided to use was supply chain risk, I measure this by searching for the words “supply chain”, “supplier”, “suppliers”, or “materials” within 5 words of “problem”, “problems”, “shortage”, “disruption”, “constraints” or “risk”. I decided to use this measurement because in the past few years there have been ongoing supply chain disruptions and shortages. If a company has a lot of “hits” for this risk it may indicate that they are having issues getting all the raw materials they need from their suppliers, they are having quality issues with their suppliers, or they simply cannot get the supplies in a timely manner. The last measurement I chose to use was Regulatory Risk, so any firms that may be affected by a change in regulations. I measured this risk by searching for instances where “Regulatory”, “Regulations”, or “Regulation” were directly next to “strict”, “new”, “additional” or “harsh”. Firms who have more exposure to regulatory risk may have to expend additional capital to keep up with a changing regulatory environment. This could range from things like being forced to sell a building in a foreign country, forced wage increases, additional expenditures on the company’s footprint, and more. All of my risk measurements got sufficient hits in my opinion, my increased competition measurement had the least number of hits for each variation, but this is too be expected as it was broken into three different measures. My Supply Chain Disruption measurement and Regulatory Pressure measures both had a 25th percentile of at least one, meaning that over 75% of the firms I parsed through returned a hit. For each of my measures, the more hits a firm returns, theoretically the more exposed to that risk they should be. Unfortunately my measurements only take into account the number of times the risk was mentioned, they are not effected by any additional actions these firms took to address the risks, and therefor correlation may not be perfect. All of my measurements should have been created in a way that they only return a hit when the variable is being talked about in a way that it increases the risk. For example, when increase and competition are seen together, it is unlikely that they are talking about a decrease in competition. However, it is possible that when “market share” and “decrease” are seen together in the document that it is referring to a competitor’s market share, and this would wrongly increase the measurement, although this variation had the lowest hits out of all my risk measures, so I am confident.

Examples of Hits:

-

“Increased competition could result in our lower vehicle unit sales, price reductions, revenue shortfalls, loss of customers and loss of market share, which may harm our business, financial condition and operating results.” –> This is an example of a hit from Tesla’s 10k, it is a good hit because it shows that Tesla is exposed to this risk.

-

“For example, productivity across our fulfillment network currently is being affected by global supply chain constraints and constrained labor markets, which increase payroll costs and make it difficult to hire, train, and deploy a sufficient number of people to operate our fulfillment network as efficiently as we would like. “ –> A supply chain measurement hit

-

“We currently are subject to, and may become subject to additional, regulations and compliance requirements (including obligations to implement enhanced authentication processes that could result in significant costs and reduce the ease of use of our payments products), as well as fraud.” –> A regulatory risk hit referring to how their business could be negatively affected by additional regulations

Examples of good misses:

-

“We also intend to further increase cost-competitiveness in our significant markets by strategically adding local manufacturing, including at Gigafactory Berlin in Germany and Gigafactory Texas in Austin, Texas, which will begin production in 2022.” –> This statement from a 10k has both the words Increase and Competitiveness, but it is not referring to a competitor in their market, so it would be a mistake if this was returned as a hit.

-

“We earn tradable credits in the operation of our automotive business under various regulations related to zero-emission vehicles, greenhouse gas, fuel economy and clean fuel. We sell these credits to other regulated entities who can use the credits to comply with emission standards and other regulatory requirements.” –> This is also a miss, it refers to regulations, but in a way that benefits the companies.

print(SP_Mr9.describe())

CIK Increased Comp. Risk 1 Increased Comp. Risk 2 \

count 3.550000e+02 352.000000 352.000000

mean 7.682979e+05 2.099432 4.653409

std 5.608935e+05 2.452698 5.827950

min 1.800000e+03 0.000000 0.000000

25% 9.348300e+04 0.000000 1.000000

50% 8.747160e+05 1.000000 3.000000

75% 1.136881e+06 3.000000 7.000000

max 1.792044e+06 16.000000 39.000000

Increased Comp. Risk 3 Increased Regulatory Risk Increased SCM Risk \

count 352.000000 352.000000 352.000000

mean 0.056818 2.855114 1.784091

std 0.243804 2.648233 1.176201

min 0.000000 0.000000 0.000000

25% 0.000000 1.000000 1.000000

50% 0.000000 2.000000 1.000000

75% 0.000000 4.000000 2.000000

max 2.000000 13.000000 7.000000

gvkey lpermno fyear sic ... prof_a \

count 355.000000 355.000000 355.000000 355.000000 ... 355.000000

mean 45305.952113 53570.729577 2018.884507 4320.836620 ... 0.151314

std 61170.060945 30143.136238 0.320067 1946.653427 ... 0.074428

min 1045.000000 10104.000000 2018.000000 100.000000 ... -0.323828

25% 6286.000000 19531.500000 2019.000000 2844.000000 ... 0.102413

50% 13700.000000 58683.000000 2019.000000 3760.000000 ... 0.138699

75% 61582.500000 82620.000000 2019.000000 5455.500000 ... 0.186883

max 316056.000000 93436.000000 2019.000000 8742.000000 ... 0.390384

ppe_a cash_a xrd_a dltt_a invopps_FG09 sales_g \

count 355.000000 355.000000 355.000000 355.000000 334.000000 0.0

mean 0.247454 0.126002 0.031169 0.296568 2.698513 NaN

std 0.218987 0.138469 0.050173 0.181230 2.107435 NaN

min 0.009521 0.002073 0.000000 0.000000 0.405435 NaN

25% 0.091581 0.031900 0.000000 0.177941 1.234730 NaN

50% 0.162561 0.072171 0.009526 0.285137 2.155533 NaN

75% 0.336729 0.166690 0.042936 0.390672 3.301717 NaN

max 0.928562 0.694612 0.336795 1.071959 12.164233 NaN

dv_a short_debt R

count 355.000000 349.000000 350.000000

mean 0.025464 0.112481 -0.123394

std 0.026991 0.111168 0.095211

min 0.000000 0.000000 -0.610145

25% 0.000000 0.028043 -0.154969

50% 0.020454 0.084992 -0.103884

75% 0.037617 0.151231 -0.062951

max 0.138594 0.761029 0.048830

[8 rows x 44 columns]

Final Sample (Above)

I don’t believe there are any real caveats in this data, however some columns are have missing data, including all my risk measures missing 3 rows. The reason for this, I believe, is that some firms were missing 10k’s and because of this they could not be parsed for hits. It is also worth noting that there are 2-5 firms in the dataset that have return data, but not data on my risk measurements.

Plots and Correlation

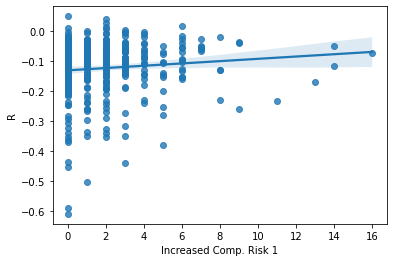

ax = sns.regplot(x= SP_Mr9['Increased Comp. Risk 1'], y = SP_Mr9['R'])

Unfortunately, this graph shows little to no relation between my first variation of increased competition risk measures and returns. This could be because my measures did not include enough words.

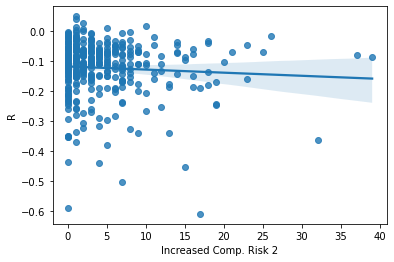

ax = sns.regplot(x= SP_Mr9['Increased Comp. Risk 2'], y = SP_Mr9['R'])

Out of all my graphs, this one has the strongest correlation to negative returns, however it is still weak. This measurement also returned the most hits out of my 3 variations of increased competition risk.

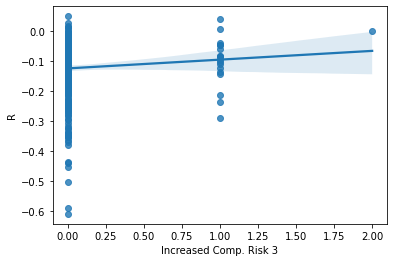

ax = sns.regplot(x= SP_Mr9['Increased Comp. Risk 3'], y = SP_Mr9['R'])

This measurement was much more hit or miss, and thus also has no real correlation.

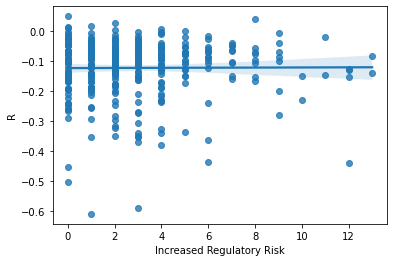

ax = sns.regplot(x= SP_Mr9['Increased Regulatory Risk'], y = SP_Mr9['R'])

Unfortunately, even though this measurment returned a lot of hits, there seems to be absolutely no relationship between the words I searched for an returns.

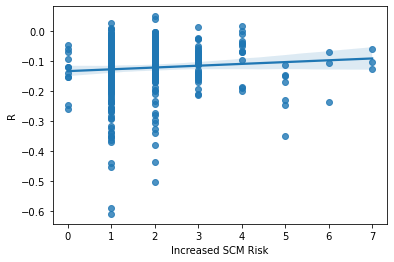

ax = sns.regplot(x= SP_Mr9['Increased SCM Risk'], y = SP_Mr9['R'])

This graph is very spread out, once again suggesting that the way I measured Supply Chain risk does not correlate to returns